Gaia's net pay each month refers to the amount of money she takes home after taxes and other deductions have been taken out of her paycheck. It is calculated by subtracting the total amount of deductions from her gross pay, which is the amount of money she earns before any deductions are taken out.

The importance of knowing your net pay is that it helps you budget your money and plan for the future. It also helps employers ensure that they are paying their employees correctly and withholding the correct amount of taxes.

There are a number of factors that can affect Gaia's net pay, including her hourly wage, the number of hours she works, and the amount of taxes and other deductions that are taken out of her paycheck. If Gaia wants to increase her net pay, she can either increase her gross pay or decrease her deductions.

What is Gaia's Net Pay Each Month?

Understanding Gaia's net pay each month is crucial for effective financial planning and budgeting. Several key aspects contribute to her net pay calculation:

- Gross Pay

- Taxes

- Deductions

- Hourly Wage

- Hours Worked

Gross pay represents Gaia's total earnings before any deductions. Taxes, such as income tax and social security, are mandatory contributions that reduce her gross pay. Deductions, which may include health insurance premiums or retirement contributions, further reduce her pay. Hourly wage and hours worked directly impact Gaia's gross pay, as they determine her total earnings before deductions.

By considering these key aspects, Gaia can make informed decisions to optimize her net pay. For instance, increasing her hourly wage or working more hours can boost her gross pay. Additionally, reviewing and adjusting her deductions can help minimize her expenses and increase her take-home pay.

1. Gross Pay

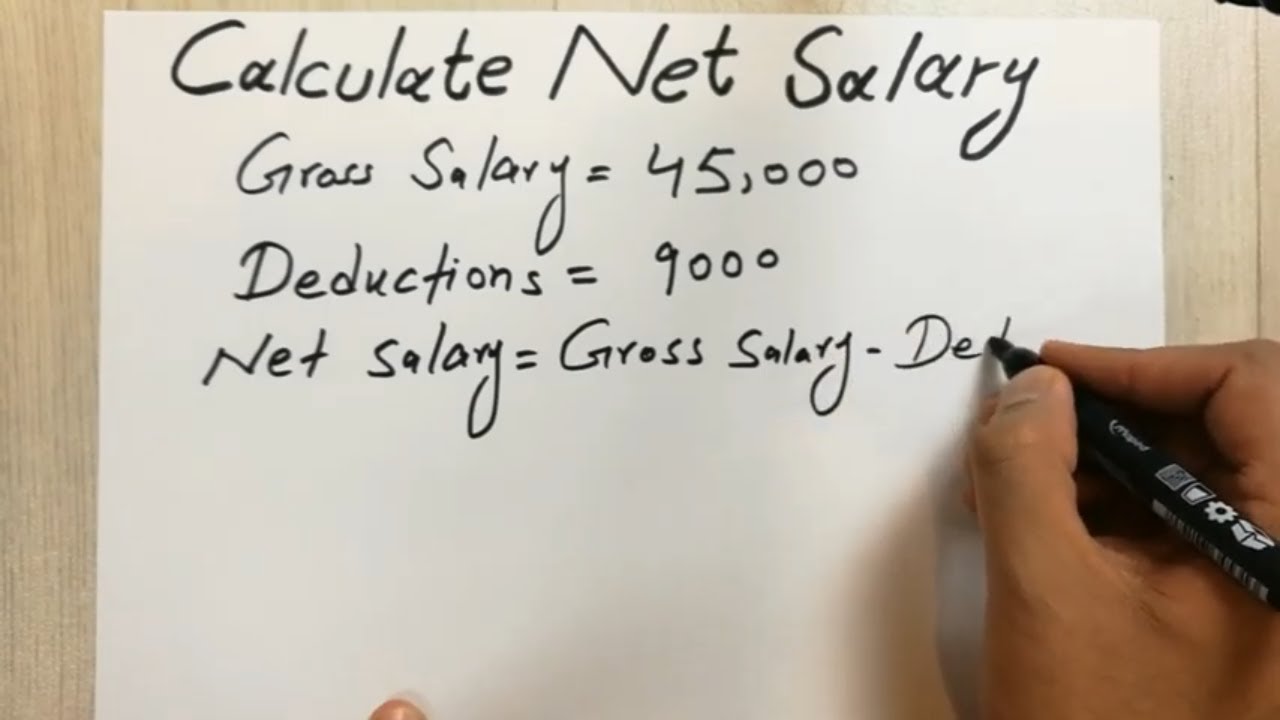

Gross pay is the total amount of money an employee earns before any deductions are taken out. It is the starting point for calculating net pay, which is the amount of money an employee takes home after taxes and other deductions have been taken out.

The importance of gross pay in relation to net pay is that it determines the maximum amount of money that an employee can take home. The higher an employee's gross pay, the higher their net pay will be, all other things being equal.

There are a number of factors that can affect an employee's gross pay, including their hourly wage, the number of hours they work, and any bonuses or commissions they earn. Employees can increase their gross pay by negotiating a higher hourly wage, working more hours, or earning more bonuses or commissions.

Understanding the relationship between gross pay and net pay is important for employees because it helps them to budget their money and plan for the future. Employees can use their gross pay to calculate their estimated net pay by subtracting the amount of taxes and other deductions that they will be required to pay.

2. Taxes

Taxes are a critical component of "what is gaia's net pay each month;" as they significantly impact the amount of money she takes home after working. Understanding the connection between taxes and net pay is crucial for financial planning and budgeting.

Taxes are mandatory contributions that Gaia must pay to the government from her gross pay. These contributions are used to fund essential public services and programs such as education, healthcare, and infrastructure. The amount of taxes Gaia pays is determined by her taxable income, which is her gross pay minus certain deductions and exemptions.

The importance of taxes in relation to net pay is that they reduce the amount of money Gaia has available to spend or save. However, it is important to remember that taxes are a necessary part of a functioning society and contribute to the common good. Without taxes, the government would not be able to provide essential services and programs that benefit all citizens.

Gaia can take steps to minimize her tax liability while ensuring she meets her legal obligations. This may involve utilizing tax deductions, credits, and exemptions to reduce her taxable income. It is advisable for Gaia to consult with a tax professional to optimize her tax strategy and maximize her net pay.

3. Deductions

Deductions play a crucial role in determining "what is gaia's net pay each month;". They represent various expenses or contributions that are subtracted from Gaia's gross pay before calculating her net pay. Understanding the connection between deductions and net pay is essential for effective financial management and planning.

The importance of deductions lies in their impact on Gaia's take-home pay. Common deductions include contributions to retirement plans, health insurance premiums, and taxes. While these deductions reduce Gaia's net pay, they serve important purposes. Retirement contributions, for example, help secure Gaia's financial future, while health insurance premiums provide coverage for medical expenses.

Gaia can make informed decisions regarding her deductions to optimize her financial situation. Reviewing her budget and prioritizing expenses can help her determine which deductions are essential and which ones can be adjusted to increase her net pay. Additionally, exploring alternative retirement plans or health insurance options may lead to cost savings and higher take-home pay.

In summary, deductions are an integral part of "what is gaia's net pay each month;". By understanding the purpose and impact of deductions, Gaia can make informed choices to manage her finances effectively, plan for the future, and maximize her net pay.

4. Hourly Wage

The connection between "Hourly Wage" and "what is gaia's net pay each month;" is significant, as hourly wage directly influences the calculation of Gaia's net pay. Hourly wage represents the rate at which Gaia earns her income for each hour worked.

- Impact on Gross Pay

Hourly wage is a key determinant of Gaia's gross pay, which is her total earnings before any deductions are taken out. The higher her hourly wage, the higher her gross pay will be, assuming she works a consistent number of hours.

- Impact on Net Pay

Since gross pay is used to calculate net pay, hourly wage indirectly affects Gaia's net pay. A higher hourly wage generally leads to a higher net pay, all other factors being equal. This is because a higher gross pay results in a higher amount of money left over after taxes and other deductions have been taken out.

- Importance for Budgeting

Understanding the connection between hourly wage and net pay is crucial for effective budgeting. By knowing her hourly wage, Gaia can estimate her gross and net pay, which helps her plan for expenses and savings.

- Negotiation and Career Growth

Hourly wage is an important consideration in salary negotiations and career growth. Gaia can use her knowledge of the connection between hourly wage and net pay to advocate for a higher wage and plan for her career advancement.

In summary, hourly wage is a fundamental factor that influences Gaia's net pay each month. By understanding this connection, Gaia can make informed decisions about her work and financial planning.

5. Hours Worked

The connection between "Hours Worked" and "what is gaia's net pay each month;" is significant, as the number of hours Gaia works directly affects her gross pay, which in turn determines her net pay.

- Impact on Gross Pay

Hours worked is a primary factor in calculating Gaia's gross pay, which is her total earnings before any deductions are taken out. The more hours she works, the higher her gross pay will be, assuming her hourly wage remains constant.

- Impact on Net Pay

Since gross pay is used to calculate net pay, hours worked indirectly affect Gaia's net pay. Working more hours generally leads to a higher net pay, all other factors being equal. This is because a higher gross pay results in a higher amount of money left over after taxes and other deductions have been taken out.

- Overtime and Shift Differentials

In some cases, working additional hours may result in overtime pay or shift differentials, which can further increase Gaia's gross and net pay.

- Work-Life Balance

While working more hours can increase Gaia's net pay, it is important to consider the impact on her work-life balance. Working excessive hours can lead to burnout and decreased productivity.

In summary, the number of hours Gaia works each month has a direct impact on her net pay. By understanding this connection, Gaia can make informed decisions about her work schedule and financial planning.

FAQs on "What is Gaia's Net Pay Each Month?"

This section addresses common questions and misconceptions surrounding the concept of "what is Gaia's net pay each month;" to provide a comprehensive understanding of the topic.

Question 1: What is the importance of knowing my net pay?

Answer: Understanding your net pay is crucial for effective financial planning and budgeting. It helps you determine how much money you have available to spend, save, and invest each month.

Question 2: What factors affect my net pay?

Answer: Your net pay is determined by several factors, including your gross pay, taxes, and deductions. Your gross pay is your total earnings before any deductions are taken out. Taxes are mandatory contributions to the government, while deductions are optional contributions, such as retirement savings or health insurance premiums.

Question 3: How can I increase my net pay?

Answer: There are two main ways to increase your net pay: increase your gross pay or decrease your deductions. To increase your gross pay, you can negotiate a higher salary, work more hours, or earn bonuses or commissions. To decrease your deductions, you can review your current deductions and eliminate any unnecessary expenses or consider adjusting your contribution amounts.

Question 4: What is the difference between gross pay and net pay?

Answer: Gross pay is your total earnings before any deductions are taken out, while net pay is the amount of money you take home after taxes and other deductions have been subtracted.

Question 5: How can I calculate my net pay?

Answer: To calculate your net pay, you need to subtract the total amount of taxes and deductions from your gross pay. You can use a net pay calculator or consult with your employer's HR department for assistance.

Question 6: What are the implications of my net pay for financial planning?

Answer: Your net pay is a key factor to consider when creating a budget and planning for the future. It determines how much money you have available to cover your expenses, save for retirement, and achieve your financial goals.

Summary of key takeaways:

- Knowing your net pay is essential for financial planning and budgeting.

- Your net pay is influenced by your gross pay, taxes, and deductions.

- You can increase your net pay by increasing your gross pay or decreasing your deductions.

- Understanding the difference between gross pay and net pay is crucial.

- Calculating your net pay is important for informed financial decision-making.

- Your net pay has significant implications for your financial planning and future goals.

Transition to the next article section: Now that you have a comprehensive understanding of "what is Gaia's net pay each month;", let's explore strategies for optimizing your net pay and achieving your financial objectives.

Tips to Optimize Your Net Pay

Understanding "what is gaia's net pay each month;" is essential, but to truly maximize your financial well-being, consider implementing the following strategies:

Tip 1: Negotiate a Higher Base Salary

During salary negotiations, research industry benchmarks and articulate your value to the organization. Aim for a base salary that aligns with your experience, skills, and market demand.

Tip 2: Explore Overtime Opportunities (if Applicable)

If overtime is available in your workplace and aligns with your schedule, consider taking on additional hours to increase your gross pay. However, be mindful of potential burnout and work-life balance.

Tip 3: Review and Adjust Deductions

Regularly review your deductions, such as retirement contributions and insurance premiums. Consider adjusting the contribution amounts to optimize your net pay while still meeting your financial goals.

Tip 4: Utilize Tax-Advantaged Accounts

Take advantage of tax-advantaged accounts, such as 401(k) plans and IRAs. Contributions to these accounts reduce your taxable income, potentially increasing your net pay.

Tip 5: Explore Employee Benefits

Inquire about employee benefits offered by your organization. Some benefits, such as flexible spending accounts or commuter assistance programs, can reduce your out-of-pocket expenses, indirectly increasing your net pay.

Summary of Key Takeaways:

- Negotiating a higher base salary can significantly impact your net pay.

- Overtime opportunities can provide an additional source of income, but work-life balance should be considered.

- Reviewing and adjusting deductions can optimize your net pay while meeting financial goals.

- Utilizing tax-advantaged accounts offers potential tax savings and increased net pay.

- Exploring employee benefits can reduce out-of-pocket expenses and indirectly boost your net pay.

Transition to the article's conclusion: By implementing these strategies, you can optimize your net pay, enhance your financial security, and work towards achieving your financial objectives.

Conclusion

Throughout this exploration of "what is Gaia's net pay each month;", we have examined the key factors that impact her take-home pay, including gross pay, taxes, deductions, hourly wage, and hours worked. Understanding these components is crucial for effective financial planning and decision-making.

Beyond the technical aspects of calculating net pay, the concept also holds significance for Gaia's financial well-being and future goals. By optimizing her net pay through strategies such as negotiating a higher salary, reviewing deductions, and utilizing tax-advantaged accounts, Gaia can increase her disposable income, enhance her financial security, and work towards achieving her financial aspirations.

In conclusion, understanding "what is Gaia's net pay each month;" is not merely an accounting exercise but a powerful tool for financial empowerment. By leveraging this knowledge, Gaia can take control of her financial situation, plan for the future, and live a more financially secure and fulfilling life.